INDIAN ECONOMY: THE UNION BUDGET

The Finance Minister

tables Ten to Twelve

documents on the Budget day. The Annual Financial Statement is the most important and main

document amount that.

“A government budget is

an annual financial statement showing item wise estimates of expected revenue

and anticipated expenditure during a fiscal year,that is often often passed by

the legislature, approved by the chief executive or president and presented by

the Finance Minister to the nation”.

Budget prepared by Department of Economic Affairs

Annual Financial Statement

Article 112 of the Constitution requires the government to present a statement of estimated receipts and expenditure in respect of every financial year - April 1 to March 31 to Parliament.

Article 112 of the Constitution requires the government to present a statement of estimated receipts and expenditure in respect of every financial year - April 1 to March 31 to Parliament.

The annual

financial statement -10-page white document.

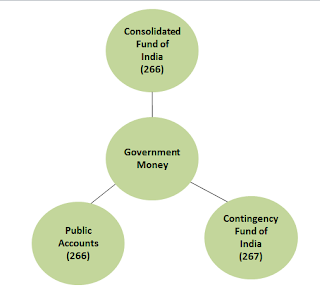

Three parts: Consolidated Fund, Contingency Fund and

Consolidated Fund

- All revenues received by the government of india by way of taxes like Income Tax, Central Excise Tax, Customs & other receipts flowing to the government in connection with the conduct of government business.

- Non-tax revenues are credited into the consolidated fund constituted under article 266(1) of the Constitution of India.

- All loans raised by the government by issue of public notifications, treasury bills(internal debt) and loans obtained from foreign governments & international institutions (external debt) are credited into consolidated fund.

- No money can be withdrawn from this fund without the Parliament's approval.

Public Accounts of India (Article 266)

- All public money other than those which are credited to the consolidated fund of India received by or on behalf of government of India shall be credited to public account of India.

Public

Accounts of India includes….

Provident

fund deposits,judicial deposits,remittances etc..

· National Investment

fund (NIF) – Money earned from disinvestment.

· National Calamity

& contingency fund (NCCF) (Under Home ministry) ,now merged with National Disaster Relief Fund (NDRF).

· National small

savings fund, defence fund, provident fund, Postal insurance etc.

·

All Cess &

Specific purpose surcharges.

·

Government schemes

Fund (Eg. MNREGA)

|

- All money flowing into these funds is called receipts, the funds received, and not revenue.

- Account is operated by Executive action (ie;without parliamentary appropriation)

- Payments are mostly in the nature of banking transactions.

Contingency Fund (Art 267)

- Any urgent or unforeseen expenditure is met from this fund.

- The Parliament enacted the contiency fund of India Act in 1950.

- The Rs 500-crore fund is at the disposal of the President.

- Contingency fund is held by finance secretary on behalf of the President.

- Any expenditure incurred from this fund requires a subsequent approval from Parliament and the amount withdrawn is returned to the fund from the consolidated fund.

Current

year Budget’s Prominent part forms next year Annual Financial Statement(Statement

1)

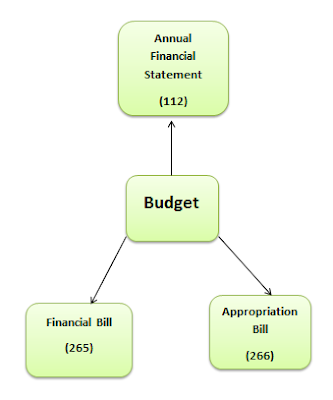

Basis of Budget:

Annual Financial

Statement(Art.112) : Requires the

government to present to Parliament a statement of estimated receipts and

expenditure in respect of every financial year.

Financial

Bill(Art.265): To get permission of Parliament to Collect Taxes from

People.

Appropriation Bill(Art.266): To get permission of

Parliament, to take out cash from Consolidated Fund of India.

Budget at a Glance

Revenue Receipts =

Tax Revenue (Net to Centre) + Non-Tax Revenue.

Capital Receipts = Recovery

of Loans +Other Receipts +Borrowings

+Other

Liabilitites

Total Receipts = Revenue Receipts+ Capital Receipts.

Revenue Account = Interest

Payments+ Grants in Aid for creation of

capital assets.

Total Expenditure

= Revenue Account+Capital Account.

Revenue Deficit = Revenue Account- Revenue Receipts.

Effective Revenue

Deficit(ERD)= Revenue Deficit-Grants in Aid for

creation of capital assets.

Fiscal

Deficit = Total Expenditure-(Revenue

Receipts+Recovery of Loans + Other Receipts)

Primary Deficit = Fiscal

Deficit- Interest Payments.

Direct Taxes

Direct taxes are the one that fall directly on individuals and

corporations.Eg, Income Tax, Corporate Tax etc.

Indirect Taxes

Indirect taxes are imposed on

goods and services. They are paid by consumers when they buy goods and services.

These include excise duty, customs duty etc.

GST

The constitution defnes “Goods and Services Tax” as any tax on supply

of goods, or services or both except taxes on the supply of the alcoholic

liquor for human consumption. “Goods” means every kind of movable property

other than money and securities but includes actionable claim, growing crops,

grass and things attached to or forming part of the land which are agreed to

be severed before supply or under a contract of supply. “Services” means anything

other than goods, money and securities but includes activities relating to

the use of money or its conversion by cash or by any other mode, from one

form, currency or denomination, to another form, currency or denomination for

which a separate consideration is charged .

Customs Duty

These are levies charged when goods are imported into, or exported

from, the country, and they are paid by the importer or exporter. Usually,

these are also passed on to the consumer.

Fiscal policy

It is the government actions with respect to aggregate levels of

revenue and spending. Fiscal policy is implemented though the budget and is

the primary means by which the government can influence the economy.

Monetary Policy

This comprises actions taken by the central bank (i.e. RBI) to regulate the level of money or

liquidity in the economy, or change the interest rates.

Inflation

A sustained increase in the general price level. The inflation rate is

the percentage rate of change in the price level.

This is the tax paid by corporations or firms on the incomes they

earn.

Minimum

Alternative Tax (MAT)

The Minimum Alternative Tax is a minimum tax that a company must pay,

even if it is under zero tax limits.

Disinvestment

The sale of shares of public sector

undertakings by the Government. The shares of government companies held by

the Government are earning assets at the disposal of the Government. If these

shares are sold to get cash, then earning assets are converted into cash, So

it is referred to as disinvestment.

|

Some Important Terms in Budget

Charged Expenditures

§ ‘Charged’ upon the consolidated fund of India.

§ Non-votable by parliament(ie;it can be only discussed

by parliament).

§ Emoluments, allowances & expenditure of

President & his office

§ Salary & allowances of chairman ,Deputy

chairman of RS ,Speaker, Deputy speaker of Lok Sabha.

§ Debt charged for which GOI is liable.

§ Salary & allowances and pension of the chairman .and members of UPSC

§ Salaries, allowances & pensions of SC judges

& CAG.

§ pensions of HC judges.

§

Stages in Budget Enactment

1.

Presentation

of Budget

2.

General

Discussion

3.

Scrutiny

by Departmental Committees.

4.

Voting

on Demands for Grants.

5.

Passing

of Appropriate Bill.

6.

Passing

of Finance Bill

Vote on account

§ Power of Lok Sabha (not of Rajya sabha) to

authorize various ministries to incur expenditures for a part of financial

year, pending the passage of appropriation bill by the parliament.

Vote of Credit

§ Granted for meeting an unexpected demand upon the

resources of India, when on account of magnitude, the demand could not be

stated with details ordinarily given in the budget.

§ It is like a blank cheque given to the executive by

the Lower House.

Supplementary Grant

§ Granted when the amount authorized by parliament

through the appropriation act for a particular service for current financial

year is found to be insufficient for that year.

Additional Grant

§ Granted when a need has arisen during current

financial year for additional expenditure for some new service, not

contemplated in budget for that year

Excess Grant

§ Granted when money has been spent on any service

during a financial year in excess of amount granted for that service in the

budget for that year.

§ It is voted by Lok sabha after the financial year.

…………………………………………………………….............................

Good attempt to ease budget terminology and process.

ReplyDelete